kaufman county tax rates

Tax rate Tax amount. Kaufman County Tax Office Locations.

Property Values Rising Again In Kaufman County Around Town Kaufmanherald Com

The minimum combined 2022 sales tax rate for Kaufman County Texas is.

. 07642 130962. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar. The median property tax on a 13000000 house is 260000 in Kaufman County.

000 Last Payment Amount for Current Year Taxes. Ad Search Kaufman County Records Online - Results In Minutes. Texas Sales Tax Rates by Zip Code.

PO Box 819 Kaufman TX 75142. 587180 Last Payer for Current Year Taxes. 2015 Top Taxpayers Report 2014 Top Taxpayers Report.

To noon at the Fire Department Administrative Offices at 150 Ninth St. Kaufman County Texas Property Tax Go To Different County 259700 Avg. The Terrell Fire Department is giving COVID-19 vaccinations every Wednesday from 8 am.

Vehicle Registration 469-376-4688 or Property Tax 469-376-4689. Kaufman County collects on average 2 of a propertys assessed fair market value as property tax. Texas has a 625 sales tax and Kaufman County collects an additional NA so the minimum sales tax rate in Kaufman County is 625 not including any city or special district taxes.

History of Tax Rates. Kaufman County Entities Freeport Exemptions. This table shows the total sales tax rates for all cities and towns in Kaufman County including all local taxes.

Current Tax Levy. Kaufman County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax. The Tax Office its officers agents employees and representatives shall not be liable for the information posted on the Tax Office Website in connection with any actions losses damages claims or liability in any way related to use of distribution of or reliance upon such information.

Watch here for budget details and interesting stories of how your tax dollars are used to improve the quality of life in Kaufman County. What is the sales tax rate in Kaufman County. The median property tax on a 13000000 house is 235300 in Texas.

Entity id entity name m o i s total rate kc kaufman county 0346618 0069704 0416322 rb road and bridge 0088635 0000000 0088635 sc crandall isd 0874700 0500000 1374700 sf forney isd 0874700 0500000 1374700 sk kaufman isd 0963000 0324600 1287600 sm mabank isd 0897800 0282200 1180000 sp kemp isd 0975600 0332331 1307931 sq. The 2018 United States Supreme Court decision in South Dakota v. Mud4 kaufman county mud 11 0410000 0590000 1000000 mud5 kaufman county mud 12 na na na mud6 kaufman county mud 5 0067500 0932500 1000000 mud7 kaufman county mud 6 0082500 0817500 0900000 mud8 kaufman county mud 7 0187500 0712500 0900000 mud9 lake vista mud 9 na na na mud4a las lomas mud 4a 1000000 0000000.

The Appraisal District is giving public notice of the capitalization rate to be used each year to appraise property receiving an exemption under Section 111825 of the Property Tax Code for Organizations Constructing or Rehabilitating Low-Income Housing. This is the total of state and county sales tax rates. The Kaufman County sales tax rate is.

587180 Current Amount Due. DAVID MARSHA MC ADAMS. The Texas state sales tax rate is currently.

The median property tax on a 13000000 house is 136500 in the United States. The tax rate was lowered by 867 percent from 504957 to 461171 per 100 valuation. Kaufman County Courthouse Annex 100 N.

Ad Find Recommended Kaufman County Tax Accountants Fast Free on Bark. Find Kaufman County Records Info From 2021. The Real Estate Center-Data for Kaufman County.

Contact Information 972 932-6081. 000 Prior Year Amount Due. Kaufman Texas 75142.

Kaufman County Tax Assessor - Collector. The county property tax rate has gone down from 5887 in 2019 to 4612 in 2022 a decrease of 12 cents or 216 percent. 000 Total Amount Due.

Property Not Previously Exempt2022 Low Income Housing Apartment Capitalization Rate. KAUFMAN COUNTY TAX OFFICE PO. Except for County Approved Holidays Questions.

Rate to be used each year to appraise property receiving an exemption under Section 111825 of the Property Tax Code for Organizations Constructing or Rehabilitating Low-Income Housing. 2 of home value Yearly median tax in Kaufman County The median property tax in Kaufman County Texas is 2597 per year for a home worth the median value of 130000. 2015_2011 TAX RATES 2014_2010 TAX RATES.

BOX 339 KAUFMAN TEXAS 75142. Get driving directions to this office. 972 932 4331 Phone The Kaufman County Tax Assessors Office is located in Kaufman Texas.

The median property tax also known as real estate tax in Kaufman County is 259700 per year based on a median home value of 13000000 and a median effective property tax rate of 200 of property value. Request for Electronic Communications.

Dallas Fort Worth 2018 Tax Rates Carlisle Title

Tax Information Independence Title

Truth In Taxation Kaufman County

Where Do Texas Homeowners Pay The Highest Property Taxes Texas Scorecard

![]()

Tax Info Kaufman Cad Official Site

County Approves Budget Lowers Tax Rate Kaufman County

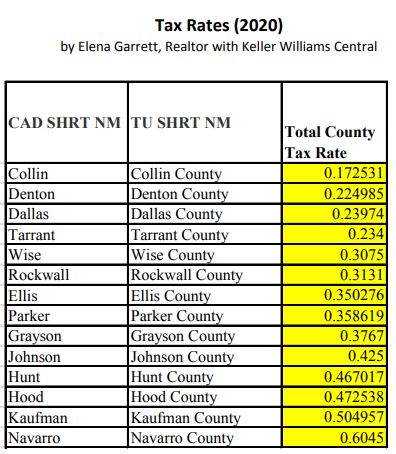

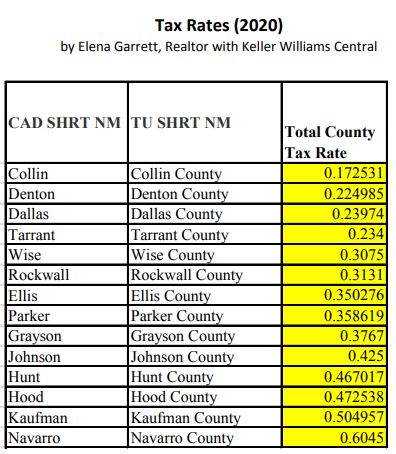

Dfw Tax Property Rates 2020 Elena Garrett Realtor In Dallas Texas My Blog